How Bitcoin Works

The Bitcoin system, unlike traditional banking and payment systems, does not require trust in third parties. Instead of a central trusted authority, in Bitcoin, each user can use software running on their own computer to verify the correct operation of every aspect of the Bitcoin system. In this chapter, we will examine Bitcoin from a high level by tracking a single transaction through the Bitcoin system and watch as it is recorded on the blockchain, the distributed journal of all transactions. Subsequent chapters will delve into the technology behind transactions, the network, and mining.

Bitcoin Overview

The Bitcoin system consists of users with wallets containing keys, transactions that are propagated across the network, and miners who produce (through competitive computation) the consensus blockchain, which is the authoritative journal of all transactions.

Each example in this chapter is based on an actual transaction made on the Bitcoin network, simulating the interactions between several users by sending funds from one wallet to another. While tracking a transaction through the Bitcoin network to the blockchain, we will use a blockchain explorer site to visualize each step. A blockchain explorer is a web application that operates as a Bitcoin search engine, in that it allows you to search for addresses, transactions, and blocks and see the relationships and flows between them.

Popular blockchain explorers include the following:

Each of these has a search function that can take a Bitcoin address, transaction hash, block number, or block hash and retrieve corresponding information from the Bitcoin network. With each transaction or block example, we will provide a URL so you can look it up yourself and study it in detail.

|

Warning

|

Block Explorer Privacy Warning

Searching information on a block explorer may disclose to its operator that you’re interested in that information, allowing them to associate it with your IP address, browser details, past searches, or other identifiable information. If you look up the transactions in this book, the operator of the block explorer might guess that you’re learning about Bitcoin, which shouldn’t be a problem. But if you look up your own transactions, the operator may be able to guess how many bitcoins you’ve received, spent, and currently own. |

Buying from an Online Store

Alice, introduced in the previous chapter, is a new user who has just acquired her first bitcoins. In [getting_first_bitcoin], Alice met with her friend Joe to exchange some cash for bitcoins. Since then, Alice has bought additional bitcoins. Now Alice will make her first spending transaction, buying access to a premium podcast episode from Bob’s online store.

Bob’s web store recently started accepting bitcoin payments by adding a Bitcoin option to its website. The prices at Bob’s store are listed in the local currency (US dollars), but at checkout, customers have the option of paying in either dollars or bitcoin.

Alice finds the podcast episode she wants to buy and proceeds to the checkout page. At checkout, Alice is offered the option to pay with bitcoin in addition to the usual options. The checkout cart displays the price in US dollars and also in bitcoin (BTC), at Bitcoin’s prevailing exchange rate.

Bob’s ecommerce system will automatically create a QR code containing an invoice (Invoice QR code.).

Unlike a QR code that simply contains a destination Bitcoin address, this invoice is a QR-encoded URI that contains a destination address, a payment amount, and a description. This allows a Bitcoin wallet application to prefill the information used to send the payment while showing a human-readable description to the user. You can scan the QR code with a bitcoin wallet application to see what Alice would see:

bitcoin:bc1qk2g6u8p4qm2s2lh3gts5cpt2mrv5skcuu7u3e4?amount=0.01577764& label=Bob%27s%20Store& message=Purchase%20at%20Bob%27s%20Store Components of the URI A Bitcoin address: "bc1qk2g6u8p4qm2s2lh3gts5cpt2mrv5skcuu7u3e4" The payment amount: "0.01577764" A label for the recipient address: "Bob's Store" A description for the payment: "Purchase at Bob's Store"

|

Tip

|

Try to scan this with your wallet to see the address and amount but DO NOT SEND MONEY. |

Alice uses her smartphone to scan the barcode on display. Her smartphone shows a payment for the correct amount to Bob's Store and she selects Send to authorize the payment. Within a few seconds (about the same amount of time as a credit card authorization), Bob sees the transaction on the register.

|

Note

|

The Bitcoin network can transact in fractional values, e.g., from millibitcoin (1/1000th of a bitcoin) down to 1/100,000,000th of a bitcoin, which is known as a satoshi. This book uses the same pluralization rules used for dollars and other traditional currencies when talking about amounts greater than one bitcoin and when using decimal notation, such as "10 bitcoins" or "0.001 bitcoins." The same rules also apply to other bitcoin bookkeeping units, such as millibitcoins and satoshis. |

You can use a block explorer to examine blockchain data, such as the payment made to Bob in Alice’s transaction.

In the following sections, we will examine this transaction in more detail. We’ll see how Alice’s wallet constructed it, how it was propagated across the network, how it was verified, and finally, how Bob can spend that amount in subsequent transactions.

Bitcoin Transactions

In simple terms, a transaction tells the network that the owner of certain bitcoins has authorized the transfer of that value to another owner. The new owner can now spend the bitcoin by creating another transaction that authorizes the transfer to another owner, and so on, in a chain of ownership.

Transaction Inputs and Outputs

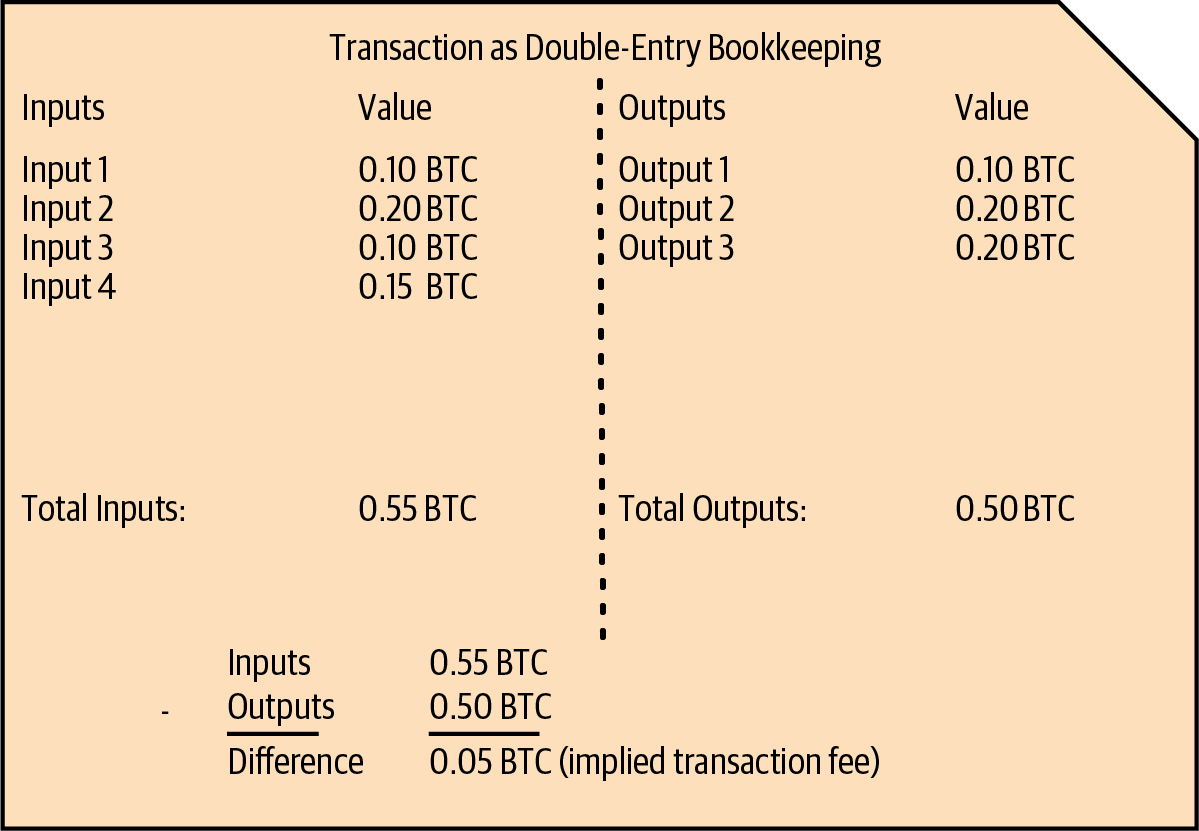

Transactions are like lines in a double-entry bookkeeping ledger. Each transaction contains one or more inputs, which spend funds. On the other side of the transaction, there are one or more outputs, which receive funds. The inputs and outputs do not necessarily add up to the same amount. Instead, outputs add up to slightly less than inputs and the difference represents an implied transaction fee, which is a small payment collected by the miner who includes the transaction in the blockchain. A Bitcoin transaction is shown as a bookkeeping ledger entry in Transaction as double-entry bookkeeping..

The transaction also contains proof of ownership for each amount of bitcoins (inputs) whose value is being spent, in the form of a digital signature from the owner, which can be independently validated by anyone. In Bitcoin terms, spending is signing a transaction that transfers value from a previous transaction over to a new owner identified by a Bitcoin address.

Transaction Chains

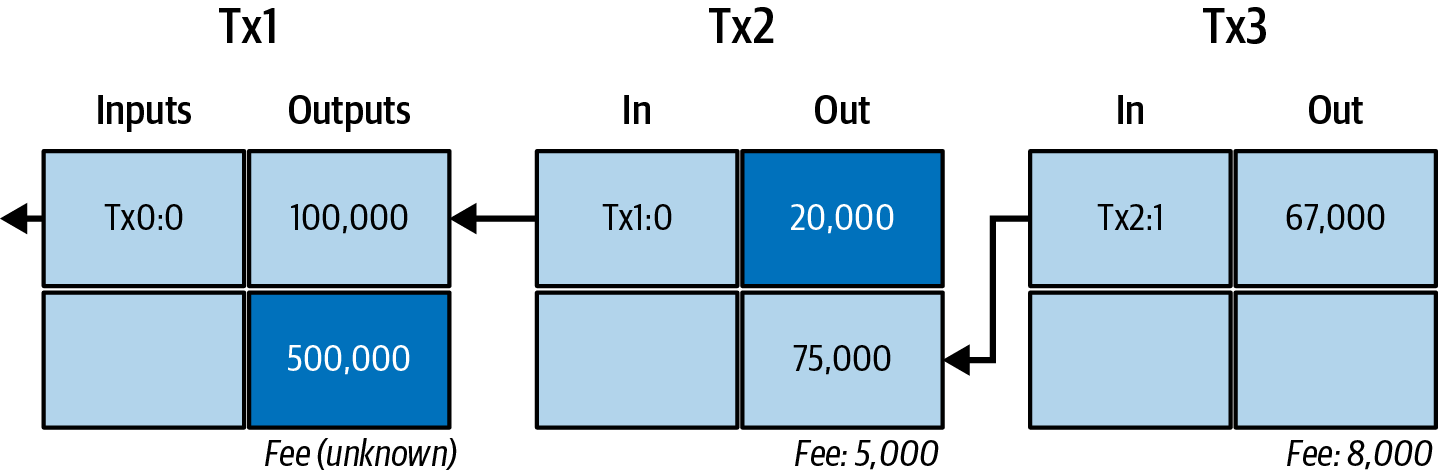

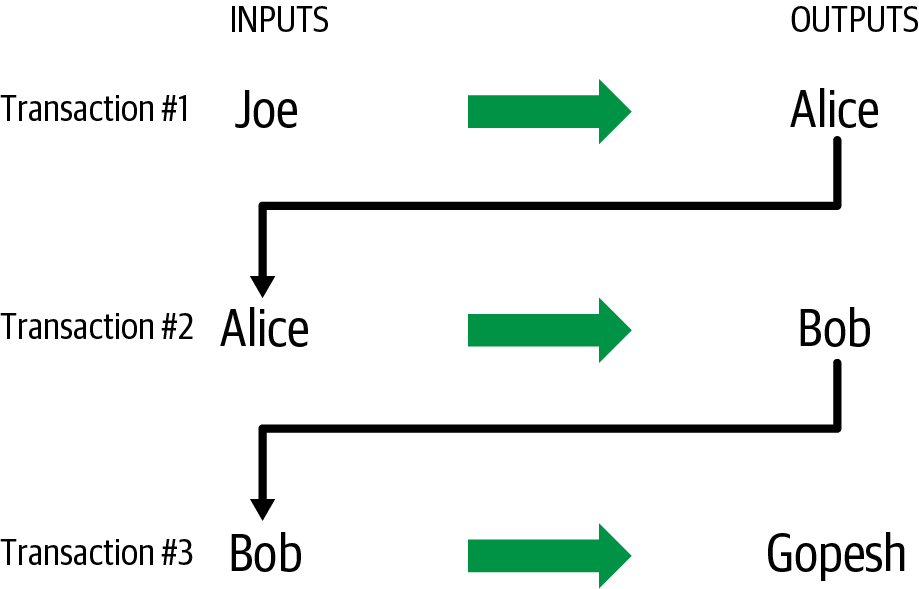

Alice’s payment to Bob’s Store uses a previous transaction’s output as its input. In the previous chapter, Alice received bitcoins from her friend Joe in return for cash. We’ve labeled that as Transaction 1 (Tx1) in A chain of transactions, where the output of one transaction is the input of the next transaction..

Tx1 sent 0.001 bitcoins (100,000 satoshis) to an output locked by Alice’s key. Her new transaction to Bob’s Store (Tx2) references the previous output as an input. In the illustration, we show that reference using an arrow and by labeling the input as "Tx1:0". In an actual transaction, the reference is the 32-byte transaction identifier (txid) for the transaction where Alice received the money from Joe. The ":0" indicates the position of the output where Alice received the money; in this case, the first position (position 0).

As shown, actual Bitcoin transactions don’t explicitly include the value of their input. To determine the value of an input, software needs to use the input’s reference to find the previous transaction output being spent.

Alice’s Tx2 contains two new outputs, one paying 75,000 satoshis for the podcast and another paying 20,000 satoshis back to Alice to receive change.

|

Tip

|

Serialized Bitcoin transactions—the data format that software uses for sending transactions—encodes the value to transfer using an integer of the smallest defined onchain unit of value. When Bitcoin was first created, this unit didn’t have a name and some developers simply called it the base unit. Later many users began calling this unit a satoshi (sat) in honor of Bitcoin’s creator. In A chain of transactions, where the output of one transaction is the input of the next transaction. and some other illustrations in this book, we use satoshi values because that’s what the protocol itself uses. |

Making Change

In addition to one or more outputs that pay the receiver of bitcoins, many transactions will also include an output that pays the spender of the bitcoins, called a change output. This is because transaction inputs, like currency notes, cannot be partly spent. If you purchase a $5 US item in a store but use a $20 bill to pay for the item, you expect to receive $15 in change. The same concept applies to Bitcoin transaction inputs. If you purchased an item that costs 5 bitcoins but only had an input worth 20 bitcoins to use, you would send one output of 5 bitcoins to the store owner and one output of 15 bitcoins back to yourself as change (not counting your transaction fee).

At the level of the Bitcoin protocol, there is no difference between a change output (and the address it pays, called a change address) and a payment output.

Importantly, the change address does not have to be the same address as that of the input and, for privacy reasons, is often a new address from the owner’s wallet. In ideal circumstances, the two different uses of outputs both use never-before-seen addresses and otherwise look identical, preventing any third party from determining which outputs are change and which are payments. However, for illustration purposes, we’ve added shading to the change outputs in A chain of transactions, where the output of one transaction is the input of the next transaction..

Not every transaction has a change output. Those that don’t are called changeless transactions, and they can have only a single output. Changeless transactions are only a practical option if the amount being spent is roughly the same as the amount available in the transaction inputs minus the anticipated transaction fee. In A chain of transactions, where the output of one transaction is the input of the next transaction., we see Bob creating Tx3 as a changeless transaction that spends the output he received in Tx2.

Coin Selection

Different wallets use different strategies when choosing which inputs to use in a payment, called coin selection.

They might aggregate many small inputs, or use one that is equal to or larger than the desired payment. Unless the wallet can aggregate inputs in such a way to exactly match the desired payment plus transaction fees, the wallet will need to generate some change. This is very similar to how people handle cash. If you always use the largest bill in your pocket, you will end up with a pocket full of loose change. If you only use the loose change, you’ll often have only big bills. People subconsciously find a balance between these two extremes, and Bitcoin wallet developers strive to program this balance.

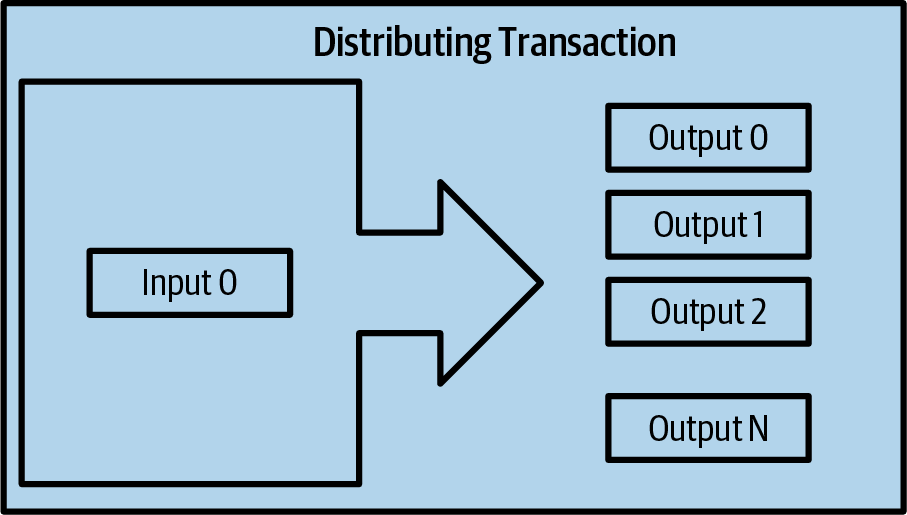

Common Transaction Forms

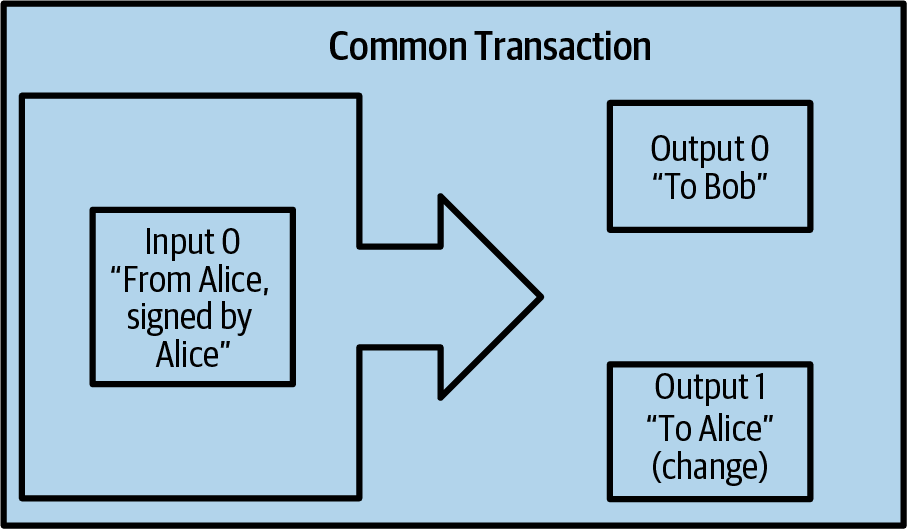

A very common form of transaction is a simple payment. This type of transaction has one input and two outputs and is shown in Most common transaction..

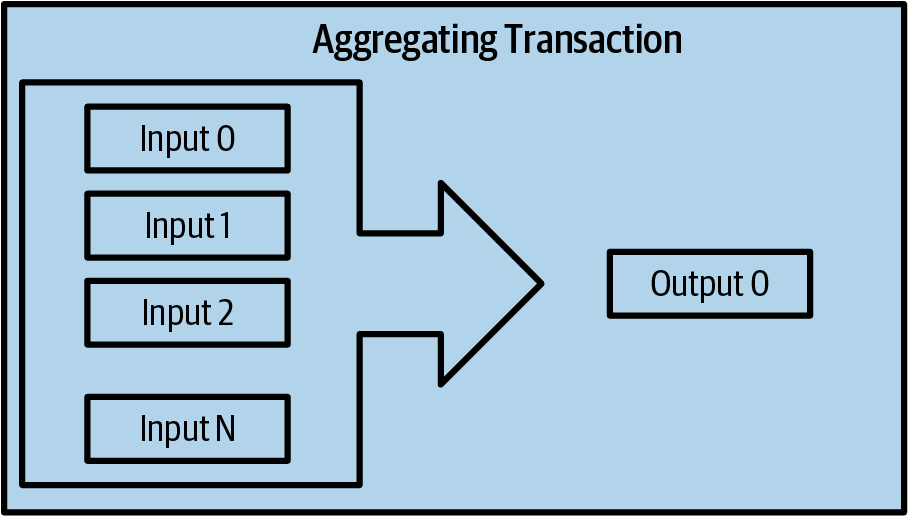

Another common form of transaction is a consolidation transaction, which spends several inputs into a single output (Consolidation transaction aggregating funds.). This represents the real-world equivalent of exchanging a pile of coins and currency notes for a single larger note. Transactions like these are sometimes generated by wallets and businesses to clean up lots of smaller amounts.

Finally, another transaction form that is seen often on the blockchain is payment batching, which pays to multiple outputs representing multiple recipients (Batch transaction distributing funds.). This type of transaction is sometimes used by commercial entities to distribute funds, such as when processing payroll payments to multiple employees.

Constructing a Transaction

Alice’s wallet application contains all the logic for selecting inputs and generating outputs to build a transaction to Alice’s specification. Alice only needs to choose a destination, amount, and transaction fee, and the rest happens in the wallet application without her seeing the details. Importantly, if a wallet already knows what inputs it controls, it can construct transactions even if it is completely offline. Like writing a check at home and later sending it to the bank in an envelope, the transaction does not need to be constructed and signed while connected to the Bitcoin network.

Getting the Right Inputs

Alice’s wallet application will first have to find inputs that can pay the amount she wants to send to Bob. Most wallets keep track of all the available outputs belonging to addresses in the wallet. Therefore, Alice’s wallet would contain a copy of the transaction output from Joe’s transaction, which was created in exchange for cash (see [getting_first_bitcoin]). A Bitcoin wallet application that runs on a full node actually contains a copy of every confirmed transaction’s unspent outputs, called unspent transaction outputs (UTXOs). However, because full nodes use more resources, many user wallets run lightweight clients that track only the user’s own UTXOs.

In this case, this single UTXO is sufficient to pay for the podcast. Had this not been the case, Alice’s wallet application might have to combine several smaller UTXOs, like picking coins from a purse, until it could find enough to pay for the podcast. In both cases, there might be a need to get some change back, which we will see in the next section, as the wallet application creates the transaction outputs (payments).

Creating the Outputs

A transaction output is created with a script that says something like, "This output is paid to whoever can present a signature from the key corresponding to Bob’s public address." Because only Bob has the wallet with the keys corresponding to that address, only Bob’s wallet can present such a signature to later spend this output. Alice will therefore encumber the output value with a demand for a signature from Bob.

This transaction will also include a second output because Alice’s funds contain more money than the cost of the podcast. Alice’s change output is created in the very same transaction as the payment to Bob. Essentially, Alice’s wallet breaks her funds into two outputs: one to Bob and one back to herself. She can then spend the change output in a subsequent transaction.

Finally, for the transaction to be processed by the network in a timely fashion, Alice’s wallet application will add a small fee. The fee is not explicitly stated in the transaction; it is implied by the difference in value between inputs and outputs. This transaction fee is collected by the miner as a fee for including the transaction in a block that gets recorded on the blockchain.

|

Tip

|

View the transaction from Alice to Bob’s Store. |

Adding the Transaction to the Blockchain

The transaction created by Alice’s wallet application contains everything necessary to confirm ownership of the funds and assign new owners. Now, the transaction must be transmitted to the Bitcoin network where it will become part of the blockchain. In the next section we will see how a transaction becomes part of a new block and how the block is mined. Finally, we will see how the new block, once added to the blockchain, is increasingly trusted by the network as more blocks are added.

Transmitting the transaction

Because the transaction contains all the information necessary for it to be processed, it does not matter how or where it is transmitted to the Bitcoin network. The Bitcoin network is a peer-to-peer network, with each Bitcoin peer participating by connecting to several other Bitcoin peers. The purpose of the Bitcoin network is to propagate transactions and blocks to all participants.

How it propagates

Peers in the Bitcoin peer-to-peer network are programs that have both the software logic and the data necessary for them to fully verify the correctness of a new transaction. The connections between peers are often visualized as edges (lines) in a graph, with the peers themselves being the nodes (dots). For that reason, Bitcoin peers are commonly called "full verification nodes," or full nodes for short.

Alice’s wallet application can send the new transaction to any Bitcoin node over any type of connection: wired, WiFi, mobile, etc. It can also send the transaction to another program (such as a block explorer) that will relay it to a node. Her Bitcoin wallet does not have to be connected to Bob’s Bitcoin wallet directly and she does not have to use the internet connection offered by Bob, though both those options are possible too. Any Bitcoin node that receives a valid transaction it has not seen before will forward it to all other nodes to which it is connected, a propagation technique known as gossiping. Thus, the transaction rapidly propagates out across the peer-to-peer network, reaching a large percentage of the nodes within a few seconds.

Bob’s view

If Bob’s Bitcoin wallet application is directly connected to Alice’s wallet application, Bob’s wallet application might be the first to receive the transaction. However, even if Alice’s wallet sends the transaction through other nodes, it will reach Bob’s wallet within a few seconds. Bob’s wallet will immediately identify Alice’s transaction as an incoming payment because it contains an output redeemable by Bob’s keys. Bob’s wallet application can also independently verify that the transaction is well formed. If Bob is using his own full node, his wallet can further verify Alice’s transaction only spends valid UTXOs.

Bitcoin Mining

Alice’s transaction is now propagated on the Bitcoin network. It does not become part of the blockchain until it is included in a block by a process called mining and that block has been validated by full nodes. See [mining] for a detailed explanation.

Bitcoin’s system of counterfeit protection is based on computation. Transactions are bundled into blocks. Blocks have a very small header that must be formed in a very specific way, requiring an enormous amount of computation to get right—but only a small amount of computation to verify as correct. The mining process serves two purposes in Bitcoin:

-

Miners can only receive honest income from creating blocks that follow all of Bitcoin’s consensus rules. Therefore, miners are normally incentivized to only include valid transactions in their blocks and the blocks they build upon. This allows users to optionally make a trust-based assumption that any transaction in a block is a valid transaction.

-

Mining currently creates new bitcoins in each block, almost like a central bank printing new money. The amount of bitcoin created per block is limited and diminishes with time, following a fixed issuance schedule.

Mining achieves a fine balance between cost and reward. Mining uses electricity to solve a computational problem. A successful miner will collect a reward in the form of new bitcoins and transaction fees. However, the reward will only be collected if the miner has only included valid transactions, with the Bitcoin protocol’s rules for consensus determining what is valid. This delicate balance provides security for Bitcoin without a central authority.

Mining is designed to be a decentralized lottery. Each miner can create their own lottery ticket by creating a candidate block that includes the new transactions they want to mine plus some additional data fields. The miner inputs their candidate into a specially designed algorithm that scrambles (or "hashes") the data, producing output that looks nothing like the input data. This hash function will always produce the same output for the same input—but nobody can predict what the output will look like for a new input, even if it is only slightly different from a previous input. If the output of the hash function matches a template determined by the Bitcoin protocol, the miner wins the lottery and Bitcoin users will accept the block with its transactions as a valid block. If the output doesn’t match the template, the miner makes a small change to their candidate block and tries again. As of this writing, the number of candidate blocks miners need to try before finding a winning combination is about 168 billion trillion. That’s also how many times the hash function needs to be run.

However, once a winning combination has been found, anyone can verify the block is valid by running the hash function just once. That makes a valid block something that requires an incredible amount of work to create but only a trivial amount of work to verify. The simple verification process is able to probabalistically prove the work was done, so the data necessary to generate that proof—in this case, the block—is called proof of work (PoW).

Transactions are added to the new block, prioritized by the highest fee rate transactions first and a few other criteria. Each miner starts the process of mining a new candidate block of transactions as soon as they receive the previous block from the network, knowing that some other miner won that iteration of the lottery. They immediately create a new candidate block with a commitment to the previous block, fill it with transactions, and start calculating the PoW for the candidate block. Each miner includes a special transaction in their candidate blocks, one that pays their own Bitcoin address the block reward plus the sum of transaction fees from all the transactions included in the candidate block. If they find a solution that makes the candidate into a valid block, they receive this reward after their successful block is added to the global blockchain and the reward transaction they included becomes spendable. Miners who participate in a mining pool have set up their software to create candidate blocks that assign the reward to a pool address. From there, a share of the reward is distributed to members of the pool miners in proportion to the amount of work they contributed.

Alice’s transaction was picked up by the network and included in the pool of unverified transactions. Once validated by a full node, it was included in a candidate block. Approximately five minutes after the transaction was first transmitted by Alice’s wallet, a miner finds a solution for the block and announces it to the network. After each other miner validates the winning block, they start a new lottery to generate the next block.

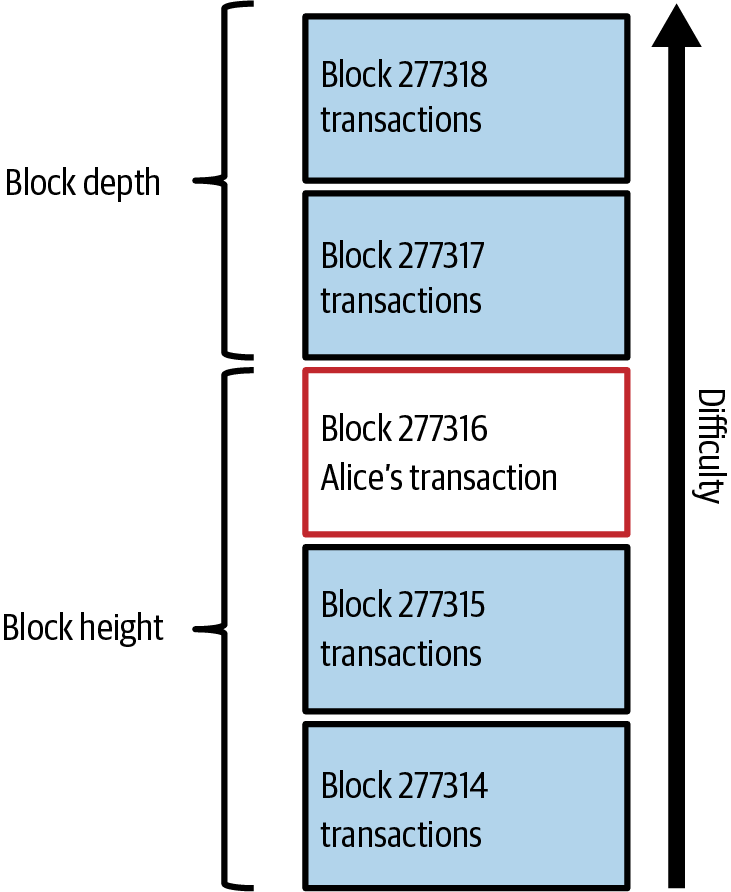

The winning block containing Alice’s transaction became part of the blockchain. The block containing Alice’s transaction is counted as one confirmation of that transaction. After the block containing Alice’s transaction has propagated through the network, creating an alternative block with a different version of Alice’s transaction (such as a transaction that doesn’t pay Bob) would require performing the same amount of work as it will take all Bitcoin miners to create an entirely new block. When there are multiple alternative blocks to choose from, Bitcoin full nodes choose the chain of valid blocks with the most total PoW, called the best blockchain. For the entire network to accept an alternative block, an additional new block would need to be mined on top of the alternative.

That means miners have a choice. They can work with Alice on an alternative to the transaction where she pays Bob, perhaps with Alice paying miners a share of the money she previously paid Bob. This dishonest behavior will require they expend the effort required to create two new blocks. Instead, miners who behave honestly can create a single new block and receive all of the fees from the transactions they include in it, plus the block subsidy. Normally, the high cost of dishonestly creating two blocks for a small additional payment is much less profitable than honestly creating a new block, making it unlikely that a confirmed transaction will be deliberately changed. For Bob, this means that he can begin to believe that the payment from Alice can be relied upon.

|

Tip

|

You can see the block that includes Alice’s transaction. |

Approximately 19 minutes after the block containing Alice’s transaction is broadcast, a new block is mined by another miner. Because this new block is built on top of the block that contained Alice’s transaction (giving Alice’s transaction two confirmations), Alice’s transaction can now only be changed if two alternative blocks are mined—plus a new block built on top of them—for a total of three blocks that would need to be mined for Alice to take back the money she sent Bob. Each block mined on top of the one containing Alice’s transaction counts as an additional confirmation. As the blocks pile on top of each other, it becomes harder to reverse the transaction, thereby giving Bob more and more confidence that Alice’s payment is secure.

In Alice’s transaction included in a block., we can see the block that contains Alice’s transaction. Below it are hundreds of thousands of blocks, linked to each other in a chain of blocks (blockchain) all the way back to block #0, known as the genesis block. Over time, as the "height" of new blocks increases, so does the computation difficulty for the chain as a whole. By convention, any block with more than six confirmations is considered very hard to change, because it would require an immense amount of computation to recalculate six blocks (plus one new block). We will examine the process of mining and the way it builds confidence in more detail in [mining].

Spending the Transaction

Now that Alice’s transaction has been embedded in the blockchain as part of a block, it is visible to all Bitcoin applications. Each Bitcoin full node can independently verify the transaction as valid and spendable. Full nodes validate every transfer of the funds from the moment the bitcoins were first generated in a block through each subsequent transaction until they reach Bob’s address. Lightweight clients can partially verify payments by confirming that the transaction is in the blockchain and has several blocks mined after it, thus providing assurance that the miners expended significant effort committing to it (see [spv_nodes]).

Bob can now spend the output from this and other transactions. For example, Bob can pay a contractor or supplier by transferring value from Alice’s podcast payment to these new owners. As Bob spends the payments received from Alice and other customers, he extends the chain of transactions. Let’s assume that Bob pays his web designer Gopesh for a new website page. Now the chain of transactions will look like Alice’s transaction as part of a transaction chain from Joe to Gopesh..

In this chapter, we saw how transactions build a chain that moves value from owner to owner. We also tracked Alice’s transaction from the moment it was created in her wallet, through the Bitcoin network, and to the miners who recorded it on the blockchain. In the rest of this book, we will examine the specific technologies behind wallets, addresses, signatures, transactions, the network, and finally, mining.