Second-Layer Applications

Let’s now build on our understanding of the primary Bitcoin system (the first layer) by looking at it as a platform for other applications, or second layers. In this chapter we will look at the features offered by Bitcoin as an application platform. We will consider the application building primitives, which form the building blocks of any blockchain application. We will look at several important applications that use these primitives, such as client-side validation, payment channels, and routed payment channels (Lightning Network).

Building Blocks (Primitives)

When operating correctly and over the long term, the Bitcoin system offers certain guarantees, which can be used as building blocks to create applications. These include:

- No double-spend

-

The most fundamental guarantee of Bitcoin’s decentralized consensus algorithm ensures that no UTXO can be spent twice in the same valid chain of blocks.

- Immutability

-

Once a transaction is recorded in the blockchain and sufficient work has been added with subsequent blocks, the transaction’s data becomes practically immutable. Immutability is underwritten by energy, as rewriting the blockchain requires the expenditure of energy to produce PoW. The energy required and therefore the degree of immutability increases with the amount of work committed on top of the block containing a transaction.

- Neutrality

-

The decentralized Bitcoin network propagates valid transactions regardless of the origin of those transactions. This means that anyone can create a valid transaction with sufficient fees and trust they will be able to transmit that transaction and have it included in the blockchain at any time.

- Secure timestamping

-

The consensus rules reject any block whose timestamp is too far in the future and attempt to prevent blocks with timestamps too far in the past. This ensures that timestamps on blocks can be trusted to a certain degree. The timestamp on a block implies an unspent-before reference for the inputs of all included transactions.

- Authorization

-

Digital signatures, validated in a decentralized network, offer authorization guarantees. Scripts that contain a requirement for a digital signature cannot be executed without authorization by the holder of the private key implied in the script.

- Auditability

-

All transactions are public and can be audited. All transactions and blocks can be linked back in an unbroken chain to the genesis block.

- Accounting

-

In any transaction (except the coinbase transaction) the value of inputs is equal to the value of outputs plus fees. It is not possible to create or destroy bitcoin value in a transaction. The outputs cannot exceed the inputs.

- Nonexpiration

-

A valid transaction does not expire. If it is valid today, it will be valid in the near future, as long as the inputs remain unspent and the consensus rules do not change.

- Integrity

-

The outputs of a Bitcoin transaction signed with SIGHASH_ALL or parts of a transaction signed by another SIGHASH type cannot be modified without invalidating the signature, thus invalidating the transaction itself.

- Transaction atomicity

-

Bitcoin transactions are atomic. They are either valid and confirmed (mined) or not. Partial transactions cannot be mined, and there is no interim state for a transaction. At any point in time a transaction is either mined or not.

- Discrete (indivisible) units of value

-

Transaction outputs are discrete and indivisible units of value. They can either be spent or unspent, in full. They cannot be divided or partially spent.

- Quorum of control

-

Multisignature constraints in scripts impose a quorum of authorization, predefined in the multisignature scheme. The requirement is enforced by the consensus rules.

- Timelock/aging

-

Any script clause containing a relative or absolute timelock can only be executed after its age exceeds the time specified.

- Replication

-

The decentralized storage of the blockchain ensures that when a transaction is mined, after sufficient confirmations, it is replicated across the network and becomes durable and resilient to power loss, data loss, etc.

- Forgery protection

-

A transaction can only spend existing, validated outputs. It is not possible to create or counterfeit value.

- Consistency

-

In the absence of miner partitions, blocks that are recorded in the blockchain are subject to reorganization or disagreement with exponentially decreasing likelihood, based on the depth at which they are recorded. Once deeply recorded, the computation and energy required to change makes change practically infeasible.

- Recording external state

-

A transaction can commit to a data value, via OP_RETURN or pay to contract, representing a state transition in an external state machine.

- Predictable issuance

-

Less than 21 million bitcoin will be issued at a predictable rate.

The list of building blocks is not complete, and more are added with each new feature introduced into Bitcoin.

Applications from Building Blocks

The building blocks offered by Bitcoin are elements of a trust platform that can be used to compose applications. Here are some examples of applications that exist today and the building blocks they use:

- Proof-of-Existence (Digital Notary)

-

Immutability + Timestamp + Durability. A transaction on the blockchain can commit to a value, proving that a piece of data existed at the time it was recorded (Timestamp). The commitment cannot be modified ex-post-facto (Immutability), and the proof will be stored permanently (Durability).

- Kickstarter (Lighthouse)

-

Consistency + Atomicity + Integrity. If you sign one input and the output (Integrity) of a fundraiser transaction, others can contribute to the fundraiser but it cannot be spent (Atomicity) until the goal (output amount) is funded (Consistency).

- Payment Channels

-

Quorum of Control + Timelock + No Double Spend + Nonexpiration + Censorship Resistance + Authorization. A multisig 2-of-2 (Quorum) with a timelock (Timelock) used as the "settlement" transaction of a payment channel can be held (Nonexpiration) and spent at any time (Censorship Resistance) by either party (Authorization). The two parties can then create commitment transactions that supersede (No Double-Spend) the settlement on a shorter timelock (Timelock).

Colored Coins

The first blockchain application we will discuss is colored coins.

Colored coins refers to a set of similar technologies that use Bitcoin transactions to record the creation, ownership, and transfer of extrinsic assets other than bitcoin. By "extrinsic" we mean assets that are not stored directly on the Bitcoin blockchain, as opposed to bitcoin itself, which is an asset intrinsic to the blockchain.

Colored coins are used to track digital assets as well as physical assets held by third parties and traded through certificates of ownership associated with colored coins. Digital asset colored coins can represent intangible assets such as a stock certificate, license, virtual property (game items), or most any form of licensed intellectual property (trademarks, copyrights, etc.). Tangible asset colored coins can represent certificates of ownership of commodities (gold, silver, oil), land titles, automobiles, boats, aircraft, etc.

The term derives from the idea of "coloring" or marking a nominal amount of bitcoin, for example, a single satoshi, to represent something other than the bitcoin amount itself. As an analogy, consider stamping a $1 note with a message saying, "this is a stock certificate of ACME" or "this note can be redeemed for 1 oz of silver" and then trading the $1 note as a certificate of ownership of this other asset. The first implementation of colored coins, named Enhanced Padded-Order-Based Coloring or EPOBC, assigned extrinsic assets to a 1-satoshi output. In this way, it was a true "colored coin," as each asset was added as an attribute (color) of a single satoshi.

More recent implementations of colored coins use other mechanisms to attach metadata with a transaction, in conjunction with external data stores that associate the metadata to specific assets. The three main mechanisms used as of this writing are single-use seals, pay to contract, and client-side validation.

Single-Use Seals

Single-use seals originate in physical security. Someone shipping an item through a third party needs a way to detect tampering, so they secure their package with a special mechanism that will become clearly damaged if the package is opened. If the package arrives with the seal intact, the sender and receiver can be confident that the package wasn’t opened in transit.

In the context of colored coins, single-use seals refer to a data structure than can only be associated with another data structure once. In Bitcoin, this definition is fulfilled by unspent transaction outputs (UTXOs). A UTXO can only be spent once within a valid blockchain, and the process of spending them associates them with the data in the spending transaction.

This provides part of the basis for the modern transfer for colored coins. One or more colored coins are received to a UTXO. When that UTXO is spent, the spending transaction must describe how the colored coins are to be spent. That brings us to pay to contract (P2C).

Pay to Contract (P2C)

We previously learned about P2C in [pay_to_contract], where it became part of the basis for the taproot upgrade to Bitcoin’s consensus rules. As a short reminder, P2C allows a spender (Bob) and receiver (Alice) to agree on some data, such as a contract, and then tweak Alice’s public key so that it commits to the contract. At any time, Bob can reveal Alice’s underlying key and the tweak used to commit to the contract, proving that she received the funds. If Alice spends the funds, that fully proves that she knew about the contract, since the only way she could spend the funds received to a P2C tweaked key is by knowing the tweak (the contract).

A powerful attribute of P2C tweaked keys is that they look like any other public keys to everyone besides Alice and Bob, unless they choose to reveal the contract used to tweak the keys. Nothing is publicly revealed about the contract—not even that a contract between them exists.

A P2C contract can be arbitrarily long and detailed, the terms can be written in any language, and it can reference anything the participants want because the contract is not validated by full nodes and only the public key with the commitment is published to the blockchain.

In the context of colored coins, Bob can open the single-use seal containing his colored coins by spending the associated UTXO. In the transaction spending that UTXO, he can commit to a contract indicating the terms that the next owner (or owners) of the colored coins must fulfill in order to further spend the coins. The new owner doesn’t need to be Alice, even though Alice is the one receiving the UTXO that Bob spends and Alice has tweaked her public key by the contract terms.

Because full nodes don’t (and can’t) validate that the contract is followed correctly, we need to figure out who is responsible for validation. That brings us to client-side validation.

Client-Side Validation

Bob had some colored coins associated with a UTXO. He spent that UTXO in a way that committed to a contract that indicated how the next receiver (or receivers) of the colored coins will prove their ownership over the coins in order to further spend them.

In practice, Bob’s P2C contract likely simply committed to one or more unique identifiers for the UTXOs that will be used as single-use seals for deciding when the colored coins are next spent. For example, Bob’s contract may have indicated that the UTXO Alice received to her P2C tweaked public key now controls half of his colored coins, with the other half of his colored coins now being assigned to a different UTXO that may have nothing to do with the transaction between Alice and Bob. This provides significant privacy against blockchain surveillance.

When Alice later wants to spend her colored coins to Dan, she first needs to prove to Dan that she controls the colored coins. Alice can do this by revealing to Dan her underlying P2C public key and the P2C contract terms chosen by Bob. Alice also reveals to Dan the UTXO that Bob used as the single-use seal and any information that Bob gave her about the previous owners of the colored coins. In short, Alice gives Dan a complete set of history about every previous transfer of the colored coins, with each step anchored in the Bitcoin blockchain (but not storing any special data in the chain—just regular public keys). That history is a lot like the history of regular Bitcoin transactions that we call the blockchain, but the colored history is completely invisible to other users of the blockchain.

Dan validates this history using his software, called client-side validation. Notably, Dan only needs to receive and validate the parts of history that pertain to the colored coins he wants to receive. He doesn’t need information about what happened to other people’s colored coins—for example, he’ll never need to know what happened to the other half of Bob’s coins, the ones that Bob didn’t transfer to Alice. This helps enhance the privacy of the colored coin protocol.

Now that we’ve learned about single-use seals, pay to contract, and client-side validation, we can look at the two main protocols that use them as of this writing, RGB and Taproot Assets.

RGB

Developers of the RGB protocol pioneered many of the ideas used in modern Bitcoin-based colored coin protocols. A primary requirement of the design for RGB was making the protocol compatible with offchain payment channels (see Payment Channels and State Channels), such as those used in Lightning Network (LN). That’s accomplished at each layer of the RGB protocol:

- Single-use seals

-

To create a payment channel, Bob assigns his colored coins to a UTXO that requires signatures from both him and Alice to spend. Their mutual control over that UTXO serves as the single-use seal for future transfers.

- Pay to contract (P2C)

-

Alice and Bob can now sign multiple versions of a P2C contract. The enforcement mechanism of the underlying payment channel ensures that both parties are incentivized to only publish the latest version of the contract onchain.

- Client-side validation

-

To ensure that neither Alice nor Bob needs to trust each other, they each check all previous transfers of the colored coins back to their creation to ensure all contract rules were followed correctly.

The developers of RGB have described other uses for their protocol, such as creating identity tokens that can be periodically updated to protect against private key compromise.

For more information, see RGB’s documentation.

Taproot Assets

Formerly called Taro, Taproot Assets are a colored coin protocol that is heavily influenced by RGB. Compared to RGB, Taproot Assets use a form of P2C contracts that is very similar to the version used by taproot for enabling MAST functionality (see [mast]). The claimed advantage of Taproot Assets over RGB is that its similarity to the widely used taproot protocol makes it simpler for wallets and other software to implement. One downside is that it may not be as flexible as the RGB protocol, especially when it comes to implementing nonasset features such as identity tokens.

|

Note

|

Taproot is part of the Bitcoin protocol. Taproot Assets is not, despite the similar name. Both RGB and Taproot Assets are protocols built on top of the Bitcoin protocol. The only asset natively supported by Bitcoin is bitcoin. |

Even more than RGB, Taproot Assets has been designed to be compatible with LN. One challenge with forwarding nonbitcoin assets over LN is that there are two ways to accomplish the sending, each with a different set of trade-offs:

- Native forwarding

-

Every hop in the path between the spender and the receiver must know about the particular asset (type of colored coin) and have a sufficient balance of it to support forwarding a payment.

- Translated forwarding

-

The hop next to the spender and the hop next to the receiver must know about the particular asset and have a sufficient balance of it to support forwarding a payment, but every other hop only needs to support forwarding bitcoin payments.

Native forwarding is conceptually simpler but essentially requires a separate Lightning-type network for every asset. Translated forwarding allows building on the economies of scale of the Bitcoin LN, but it may be vulnerable to a problem called the free American call option, where a receiver may selectively accept or reject certain payments depending on recent changes to the exchange rate in order to siphon money from the hop next to them. Although there’s no known perfect solution to the free American call option, there may be practical solutions that limit its harm.

Both Taproot Assets and RGB can technically support both native and translated forwarding. Taproot Assets is specifically designed around translated forwarding, whereas RGB has seen proposals to implement both.

For more information, see Taproot Asset’s documentation. Additionally, the Taproot Asset developers are working on BIPs that may be available after this book goes into print.

Payment Channels and State Channels

Payment channels are a trustless mechanism for exchanging Bitcoin transactions between two parties outside of the Bitcoin blockchain. These transactions, which would be valid if settled on the Bitcoin blockchain, are held offchain instead, waiting for eventual batch settlement. Because the transactions are not settled, they can be exchanged without the usual settlement latency, allowing extremely high transaction throughput, low latency, and fine granularity.

Actually, the term channel is a metaphor. State channels are virtual constructs represented by the exchange of state between two parties outside of the blockchain. There are no "channels" per se, and the underlying data transport mechanism is not the channel. We use the term channel to represent the relationship and shared state between two parties outside of the blockchain.

To further explain this concept, think of a TCP stream. From the perspective of higher-level protocols, it is a "socket" connecting two applications across the internet. But if you look at the network traffic, a TCP stream is just a virtual channel over IP packets. Each endpoint of the TCP stream sequences and assembles IP packets to create the illusion of a stream of bytes. Underneath, it’s all disconnected packets. Similarly, a payment channel is just a series of transactions. If properly sequenced and connected, they create redeemable obligations that you can trust even though you don’t trust the other side of the channel.

In this section we will look at various forms of payment channels. First, we will examine the mechanisms used to construct a one-way (unidirectional) payment channel for a metered micropayment service, such as streaming video. Then, we will expand on this mechanism and introduce bidirectional payment channels. Finally, we will look at how bidirectional channels can be connected end-to-end to form multihop channels in a routed network, first proposed under the name Lightning Network.

Payment channels are part of the broader concept of a state channel, which represents an offchain alteration of state, secured by eventual settlement in a blockchain. A payment channel is a state channel where the state being altered is the balance of a virtual currency.

State Channels—Basic Concepts and Terminology

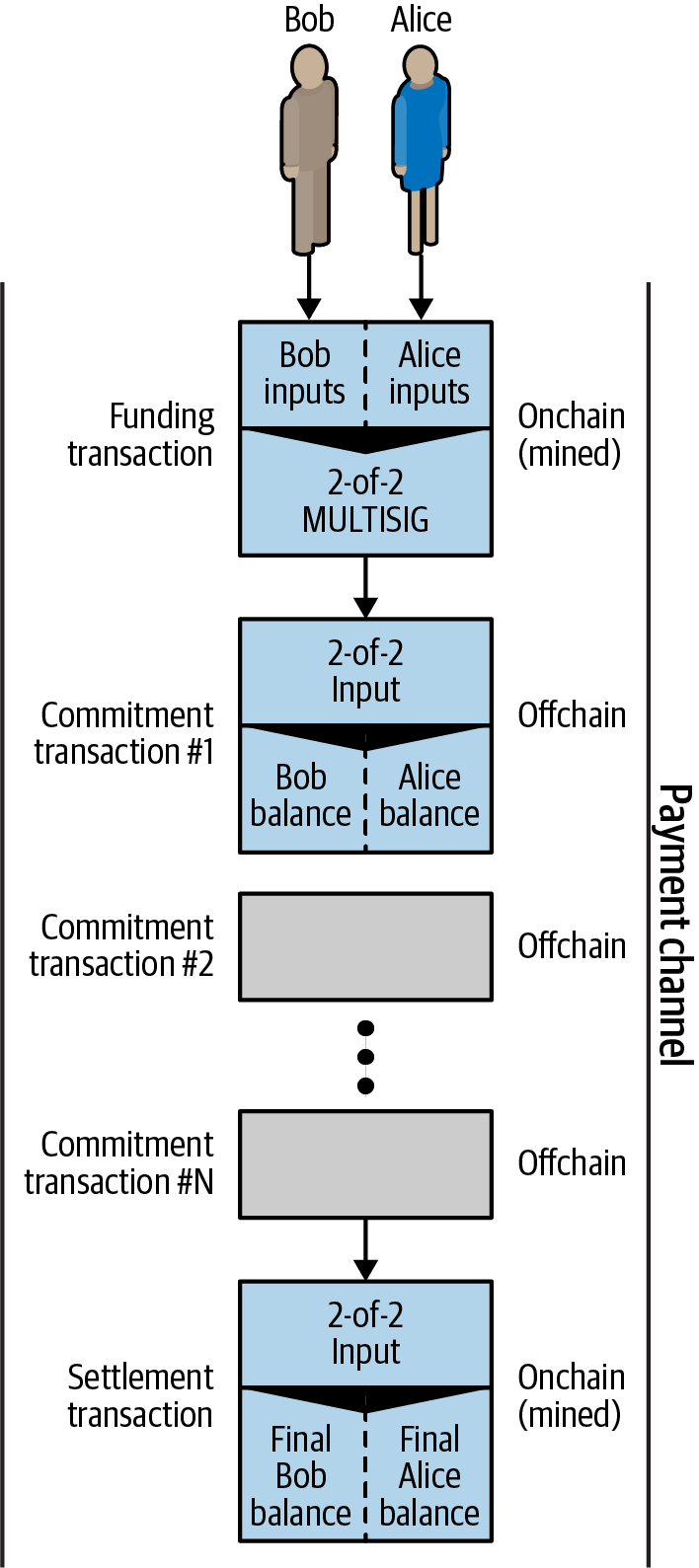

A state channel is established between two parties through a transaction that locks a shared state on the blockchain. This is called the funding transaction. This single transaction must be transmitted to the network and mined to establish the channel. In the example of a payment channel, the locked state is the initial balance (in currency) of the channel.

The two parties then exchange signed transactions, called commitment transactions, that alter the initial state. These transactions are valid transactions in that they could be submitted for settlement by either party, but instead are held offchain by each party pending the channel closure. State updates can be created as fast as each party can create, sign, and transmit a transaction to the other party. In practice this means that dozens of transactions per second can be exchanged.

When exchanging commitment transactions the two parties also discourage use of the previous states, so that the most up-to-date commitment transaction is always the best one to be redeemed. This discourages either party from cheating by unilaterally closing the channel with a prior state that is more favorable to them than the current state. We will examine the various mechanisms that can be used to discourage publication of prior states in the rest of this chapter.

Finally, the channel can be closed either cooperatively, by submitting a final settlement transaction to the blockchain, or unilaterally, by either party submitting the last commitment transaction to the blockchain. A unilateral close option is needed in case one of the parties unexpectedly disconnects. The settlement transaction represents the final state of the channel and is settled on the blockchain.

In the entire lifetime of the channel, only two transactions need to be submitted for mining on the blockchain: the funding and settlement transactions. In between these two states, the two parties can exchange any number of commitment transactions that are never seen by anyone else or submitted to the blockchain.

A payment channel between Bob and Alice, showing the funding, commitment, and settlement transactions. illustrates a payment channel between Bob and Alice, showing the funding, commitment, and settlement transactions.

Simple Payment Channel Example

To explain state channels, we start with a very simple example. We demonstrate a one-way channel, meaning that value is flowing in one direction only. We will also start with the naive assumption that no one is trying to cheat to keep things simple. Once we have the basic channel idea explained, we will then look at what it takes to make it trustless so that neither party can cheat, even if they are trying to.

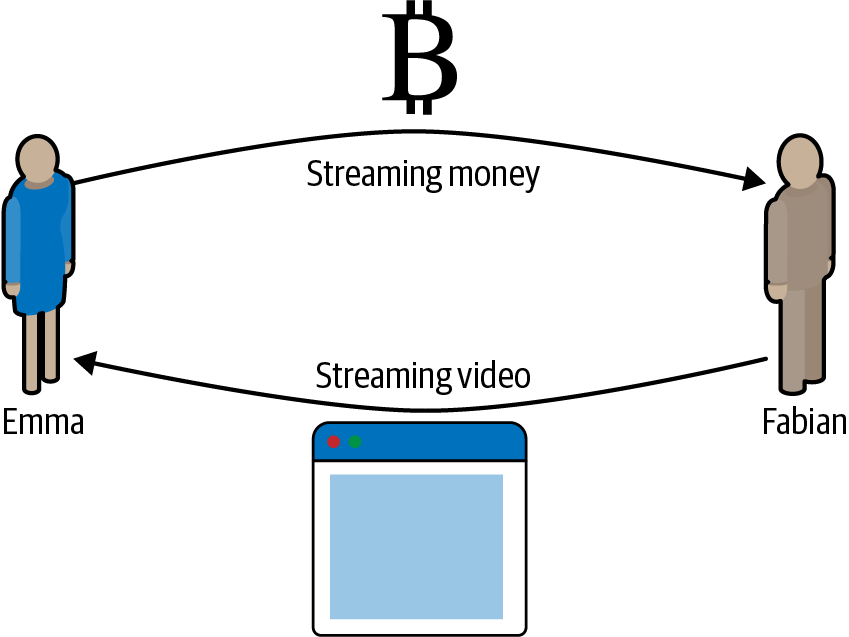

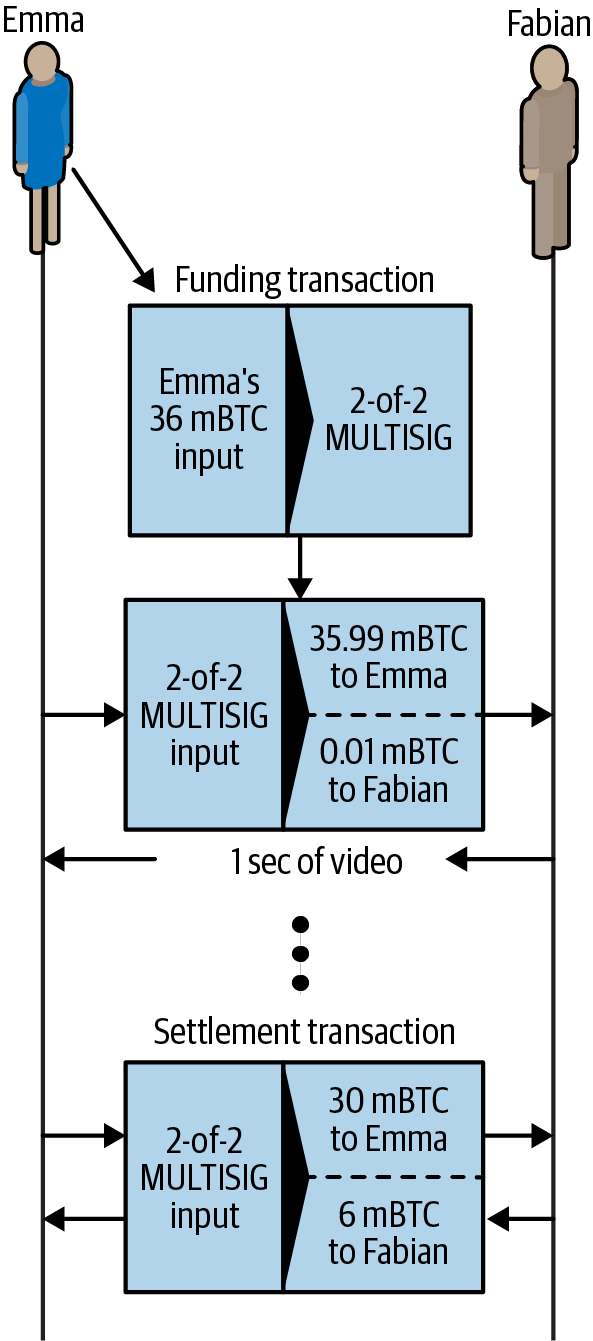

For this example we will assume two participants: Emma and Fabian. Fabian offers a video streaming service that is billed by the second using a micropayment channel. Fabian charges 0.01 millibit (0.00001 BTC) per second of video, equivalent to 36 millibits (0.036 BTC) per hour of video. Emma is a user who purchases this streaming video service from Fabian. Emma purchases streaming video from Fabian with a payment channel, paying for each second of video. shows Emma buying the video streaming service from Fabian using a payment channel.

In this example, Fabian and Emma are using special software that handles both the payment channel and the video streaming. Emma is running the software in her browser; Fabian is running it on a server. The software includes basic Bitcoin wallet functionality and can create and sign Bitcoin transactions. Both the concept and the term "payment channel" are completely hidden from the users. What they see is video that is paid for by the second.

To set up the payment channel, Emma and Fabian establish a 2-of-2 multisignature address, with each of them holding one of the keys. From Emma’s perspective, the software in her browser presents a QR code with the address, and asks her to submit a "deposit" for up to 1 hour of video. The address is then funded by Emma. Emma’s transaction, paying to the multisignature address, is the funding or anchor transaction for the payment channel.

For this example, let’s say that Emma funds the channel with 36 millibits (0.036 BTC). This will allow Emma to consume up to 1 hour of streaming video. The funding transaction in this case sets the maximum amount that can be transmitted in this channel, setting the channel capacity.

The funding transaction consumes one or more inputs from Emma’s wallet, sourcing the funds. It creates one output with an amount of 36 millibits paid to the multisignature 2-of-2 address controlled jointly between Emma and Fabian. It may have additional outputs for change back to Emma’s wallet.

After the funding transaction is confirmed to a sufficient depth, Emma can start streaming video. Emma’s software creates and signs a commitment transaction that changes the channel balance to credit 0.01 millibit to Fabian’s address and refund 35.99 millibits back to Emma. The transaction signed by Emma consumes the 36 millibits output created by the funding transaction and creates two outputs: one for her refund, the other for Fabian’s payment. The transaction is only partially signed—it requires two signatures (2-of-2), but only has Emma’s signature. When Fabian’s server receives this transaction, it adds the second signature (for the 2-of-2 input) and returns it to Emma together with 1 second worth of video. Now both parties have a fully signed commitment transaction that either can redeem, representing the correct up-to-date balance of the channel. Neither party broadcasts this transaction to the network.

In the next round, Emma’s software creates and signs another commitment transaction (commitment #2) that consumes the same 2-of-2 output from the funding transaction. The second commitment transaction allocates one output of 0.02 millibits to Fabian’s address and one output of 35.98 millibits back to Emma’s address. This new transaction is payment for two cumulative seconds of video. Fabian’s software signs and returns the second commitment transaction, together with another second of video.

In this way, Emma’s software continues to send commitment transactions to Fabian’s server in exchange for streaming video. The balance of the channel gradually accumulates in favor of Fabian as Emma consumes more seconds of video. Let’s say Emma watches 600 seconds (10 minutes) of video, creating and signing 600 commitment transactions. The last commitment transaction (#600) will have two outputs, splitting the balance of the channel, 6 millibits to Fabian and 30 millibits to Emma.

Finally, Emma clicks "Stop" to stop streaming video. Either Fabian or Emma can now transmit the final state transaction for settlement. This last transaction is the settlement transaction and pays Fabian for all the video Emma consumed, refunding the remainder of the funding transaction to Emma.

Emma’s payment channel with Fabian, showing the commitment transactions that update the balance of the channel. shows the channel between Emma and Fabian and the commitment transactions that update the balance of the channel.

In the end, only two transactions are recorded on the blockchain: the funding transaction that established the channel and a settlement transaction that allocated the final balance correctly between the two participants.

Making Trustless Channels

The channel we just described works, but only if both parties cooperate, without any failures or attempts to cheat. Let’s look at some of the scenarios that break this channel and see what is needed to fix those:

-

Once the funding transaction happens, Emma needs Fabian’s signature to get any money back. If Fabian disappears, Emma’s funds are locked in a 2-of-2 and effectively lost. This channel, as constructed, leads to a loss of funds if one of the parties becomes unavailable before there is at least one commitment transaction signed by both parties.

-

While the channel is running, Emma can take any of the commitment transactions Fabian has countersigned and transmit one to the blockchain. Why pay for 600 seconds of video if she can transmit commitment transaction #1 and only pay for 1 second of video? The channel fails because Emma can cheat by broadcasting a prior commitment that is in her favor.

Both of these problems can be solved with timelocks—let’s look at how we could use transaction-level timelocks.

Emma cannot risk funding a 2-of-2 multisig unless she has a guaranteed refund. To solve this problem, Emma constructs the funding and refund transaction at the same time. She signs the funding transaction but doesn’t transmit it to anyone. Emma transmits only the refund transaction to Fabian and obtains his signature.

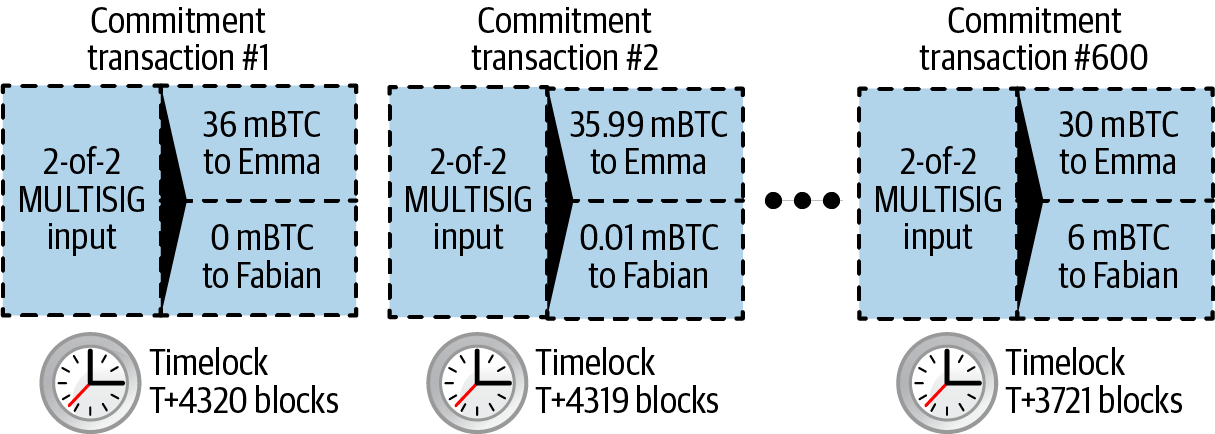

The refund transaction acts as the first commitment transaction, and its timelock establishes the upper bound for the channel’s life. In this case, Emma could set the lock time to 30 days or 4,320 blocks into the future. All subsequent commitment transactions must have a shorter timelock so they can be redeemed before the refund transaction.

Now that Emma has a fully signed refund transaction, she can confidently transmit the signed funding transaction knowing that she can eventually, after the timelock expires, redeem the refund transaction even if Fabian disappears.

Every commitment transaction the parties exchange during the life of the channel will be timelocked into the future. But the delay will be slightly shorter for each commitment, so the most recent commitment can be redeemed before the prior commitment it invalidates. Because of the lock time, neither party can successfully propagate any of the commitment transactions until their timelock expires. If all goes well, they will cooperate and close the channel gracefully with a settlement transaction, making it unnecessary to transmit an intermediate commitment transaction. If not, the most recent commitment transaction can be propagated to settle the account and invalidate all prior commitment transactions.

For example, if commitment transaction #1 is timelocked to 4,320 blocks in the future, then commitment transaction #2 is timelocked to 4,319 blocks in the future. Commitment transaction #600 can be spent 600 blocks before commitment transaction #1 becomes valid.

Each commitment sets a shorter timelock, allowing it to be spent before the previous commitments become valid. shows each commitment transaction setting a shorter timelock, allowing it to be spent before the previous commitments become valid.

Each subsequent commitment transaction must have a shorter timelock so that it may be broadcast before its predecessors and before the refund transaction. The ability to broadcast a commitment earlier ensures it will be able to spend the funding output and preclude any other commitment transaction from being redeemed by spending the output. The guarantees offered by the Bitcoin blockchain, preventing double-spends and enforcing timelocks, effectively allow each commitment transaction to invalidate its predecessors.

State channels use timelocks to enforce smart contracts across a time dimension. In this example we saw how the time dimension guarantees that the most recent commitment transaction becomes valid before any earlier commitments. Thus, the most recent commitment transaction can be transmitted, spending the inputs and invalidating prior commitment transactions. The enforcement of smart contracts with absolute timelocks protects against cheating by one of the parties. This implementation needs nothing more than absolute transaction-level lock time. Next, we will see how script-level timelocks, CHECKLOCKTIMEVERIFY and CHECKSEQUENCEVERIFY, can be used to construct more flexible, useful, and sophisticated state channels.

Timelocks are not the only way to invalidate prior commitment transactions. In the next sections we will see how a revocation key can be used to achieve the same result. Timelocks are effective, but they have two distinct disadvantages. By establishing a maximum timelock when the channel is first opened, they limit the lifetime of the channel. Worse, they force channel implementations to strike a balance between allowing long-lived channels and forcing one of the participants to wait a very long time for a refund in case of premature closure. For example, if you allow the channel to remain open for 30 days by setting the refund timelock to 30 days, if one of the parties disappears immediately, the other party must wait 30 days for a refund. The more distant the endpoint, the more distant the refund.

The second problem is that since each subsequent commitment transaction must decrement the timelock, there is an explicit limit on the number of commitment transactions that can be exchanged between the parties. For example, a 30-day channel, setting a timelock of 4,320 blocks into the future, can only accommodate 4,320 intermediate commitment transactions before it must be closed. There is a danger in setting the timelock commitment transaction interval at 1 block. By setting the timelock interval between commitment transactions to 1 block, a developer is creating a very high burden for the channel participants who have to be vigilant, remain online and watching, and be ready to transmit the right commitment transaction at any time.

In the preceding example of a single-direction channel, it’s easy to eliminate the per-commitment timelock. After Emma receives the signature on the timelocked refund transaction from Fabian, no timelocks are placed on the commitment transactions. Instead, Emma sends her signature on each commitment transaction to Fabian but Fabian doesn’t send her any of his signatures on the commitment transactions. That means only Fabian has both signatures for a commitment transaction, so only he can broadcast one of those commitments. When Emma finishes streaming video, Fabian will always prefer to broadcast the transaction that pays him the most—which will be the latest state. This construction in called a Spillman-style payment channel, which was first described and implemented in 2013, although they are only safe to use with witness (segwit) transactions, which didn’t become available until 2017.

Now that we understand how timelocks can be used to invalidate prior commitments, we can see the difference between closing the channel cooperatively and closing it unilaterally by broadcasting a commitment transaction. All commitment transactions in our prior example were timelocked, therefore broadcasting a commitment transaction will always involve waiting until the timelock has expired. But if the two parties agree on what the final balance is and know they both hold commitment transactions that will eventually make that balance a reality, they can construct a settlement transaction without a timelock representing that same balance. In a cooperative close, either party takes the most recent commitment transaction and builds a settlement transaction that is identical in every way except that it omits the timelock. Both parties can sign this settlement transaction knowing there is no way to cheat and get a more favorable balance. By cooperatively signing and transmitting the settlement transaction, they can close the channel and redeem their balance immediately. Worst case, one of the parties can be petty, refuse to cooperate, and force the other party to do a unilateral close with the most recent commitment transaction. If they do that, they have to wait for their funds too.

Asymmetric Revocable Commitments

Another way to handle the prior commitment states is to explicitly revoke them. However, this is not easy to achieve. A key characteristic of Bitcoin is that once a transaction is valid, it remains valid and does not expire. The only way to cancel a transaction is to get a conflicting transaction confirmed. That’s why we used timelocks in the simple payment channel example to ensure that more recent commitments could be spent before older commitments were valid. However, sequencing commitments in time creates a number of constraints that make payment channels difficult to use.

Even though a transaction cannot be canceled, it can be constructed in such a way as to make it undesirable to use. The way we do that is by giving each party a revocation key that can be used to punish the other party if they try to cheat. This mechanism for revoking prior commitment transactions was first proposed as part of the LN.

To explain revocation keys, we will construct a more complex payment channel between two exchanges run by Hitesh and Irene. Hitesh and Irene run Bitcoin exchanges in India and the USA, respectively. Customers of Hitesh’s Indian exchange often send payments to customers of Irene’s USA exchange and vice versa. Currently, these transactions occur on the Bitcoin blockchain, but this means paying fees and waiting several blocks for confirmations. Setting up a payment channel between the exchanges will significantly reduce the cost and accelerate the transaction flow.

Hitesh and Irene start the channel by collaboratively constructing a funding transaction, each funding the channel with 5 bitcoin. Before they sign the funding transaction, they must sign the first set of commitments (called the refund) that assigns the initial balance of 5 bitcoin for Hitesh and 5 bitcoin for Irene. The funding transaction locks the channel state in a 2-of-2 multisig, just like in the example of a simple channel.

The funding transaction may have one or more inputs from Hitesh (adding up to 5 bitcoins or more), and one or more inputs from Irene (adding up to 5 bitcoins or more). The inputs have to slightly exceed the channel capacity in order to cover the transaction fees. The transaction has one output that locks the 10 total bitcoins to a 2-of-2 multisig address controlled by both Hitesh and Irene. The funding transaction may also have one or more outputs returning change to Hitesh and Irene if their inputs exceeded their intended channel contribution. This is a single transaction with inputs offered and signed by two parties. It has to be constructed in collaboration and signed by each party before it is transmitted.

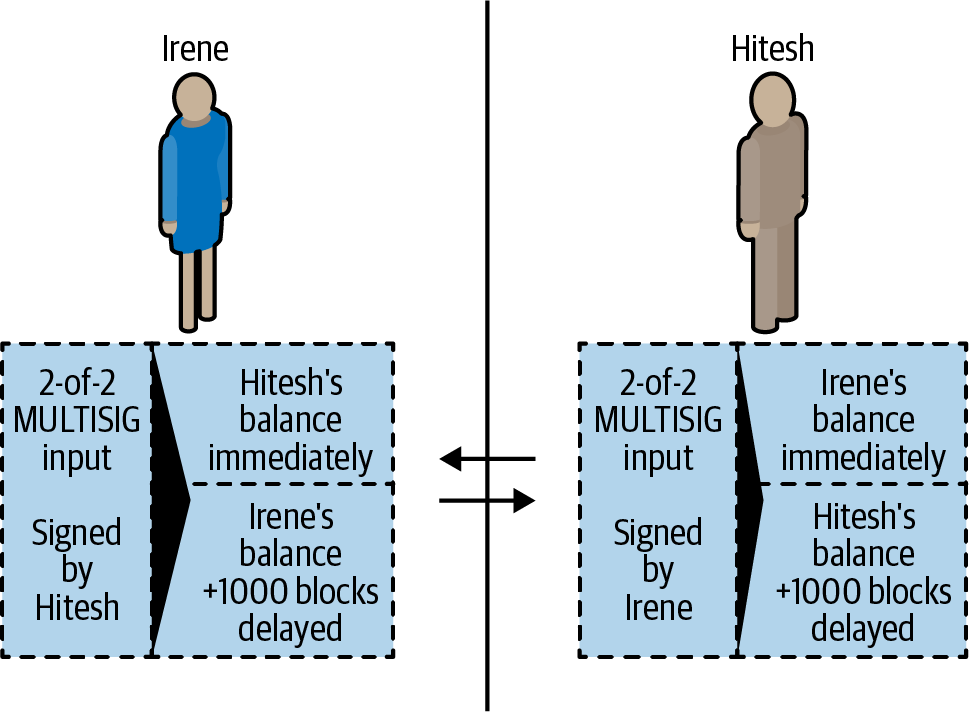

Now, instead of creating a single commitment transaction that both parties sign, Hitesh and Irene create two different commitment transactions that are asymmetric.

Hitesh has a commitment transaction with two outputs. The first output pays Irene the 5 bitcoins she is owed immediately. The second output pays Hitesh the 5 bitcoins he is owed, but only after a timelock of 1,000 blocks. The transaction outputs look like this:

Input: 2-of-2 funding output, signed by Irene

Output 0 <5 bitcoins>:

<Irene's Public Key> CHECKSIG

Output 1 <5 bitcoins>:

<1000 blocks>

CHECKSEQUENCEVERIFY

DROP

<Hitesh's Public Key> CHECKSIG

Irene has a different commitment transaction with two outputs. The first output pays Hitesh the 5 bitcoins he is owed immediately. The second output pays Irene the 5 bitcoins she is owed but only after a timelock of 1,000 blocks. The commitment transaction Irene holds (signed by Hitesh) looks like this:

Input: 2-of-2 funding output, signed by Hitesh

Output 0 <5 bitcoins>:

<Hitesh's Public Key> CHECKSIG

Output 1 <5 bitcoins>:

<1000 blocks>

CHECKSEQUENCEVERIFY

DROP

<Irene's Public Key> CHECKSIG

This way, each party has a commitment transaction, spending the 2-of-2 funding output. This input is signed by the other party. At any time the party holding the transaction can also sign (completing the 2-of-2) and broadcast. However, if they broadcast the commitment transaction, it pays the other party immediately, whereas they have to wait for a timelock to expire. By imposing a delay on the redemption of one of the outputs, we put each party at a slight disadvantage when they choose to unilaterally broadcast a commitment transaction. But a time delay alone isn’t enough to encourage fair conduct.

Two asymmetric commitment transactions with delayed payment for the party holding the transaction. shows two asymmetric commitment transactions, where the output paying the holder of the commitment is delayed.

Now we introduce the final element of this scheme: a revocation key that prevents a cheater from broadcasting an expired commitment. The revocation key allows the wronged party to punish the cheater by taking the entire balance of the channel.

The revocation key is composed of two secrets, each half generated independently by each channel participant. It is similar to a 2-of-2 multisig, but constructed using elliptic curve arithmetic, so that both parties know the revocation public key but each party knows only half the revocation secret key.

In each round, both parties reveal their half of the revocation secret to the other party, thereby giving the other party (who now has both halves) the means to claim the penalty output if this revoked transaction is ever broadcast.

Each of the commitment transactions has a "delayed" output. The redemption script for that output allows one party to redeem it after 1,000 blocks, or the other party to redeem it if they have a revocation key, penalizing transmission of a revoked commitment.

So when Hitesh creates a commitment transaction for Irene to sign, he makes the second output payable to himself after 1,000 blocks or to the revocation public key (of which he only knows half the secret). Hitesh constructs this transaction. He will only reveal his half of the revocation secret to Irene when he is ready to move to a new channel state and wants to revoke this commitment.

The second output’s script looks like this:

Output 0 <5 bitcoins>:

<Irene's Public Key> CHECKSIG

Output 1 <5 bitcoins>:

IF

# Revocation penalty output

<Revocation Public Key>

ELSE

<1000 blocks>

CHECKSEQUENCEVERIFY

DROP

<Hitesh's Public Key>

ENDIF

CHECKSIG

Irene can confidently sign this transaction since if transmitted, it will immediately pay her what she is owed. Hitesh holds the transaction but knows that if he transmits it in a unilateral channel closing, he will have to wait 1,000 blocks to get paid.

After the channel is advanced to the next state, Hitesh has to revoke this commitment transaction before Irene will agree to sign any further commitment transactions. To do that, all he has to do is send his half of the revocation key to Irene. Once Irene has both halves of the revocation secret key for this commitment, she can sign a future commitment with confidence. She knows that if Hitesh tries to cheat by publishing the prior commitment, she can use the revocation key to redeem Hitesh’s delayed output. If Hitesh cheats, Irene gets BOTH outputs. Meanwhile, Hitesh only has half the revocation secret for that revocation public key and can’t redeem the output until 1,000 blocks. Irene will be able to redeem the output and punish Hitesh before the 1,000 blocks have elapsed.

The revocation protocol is bilateral, meaning that in each round, as the channel state is advanced, the two parties exchange new commitments, exchange revocation secrets for the previous commitments, and sign each other’s new commitment transactions. After they accept a new state, they make the prior state impossible to use by giving each other the necessary revocation secrets to punish any cheating.

Let’s look at an example of how it works. One of Irene’s customers wants to send 2 bitcoins to one of Hitesh’s customers. To transmit 2 bitcoins across the channel, Hitesh and Irene must advance the channel state to reflect the new balance. They will commit to a new state (state number 2) where the channel’s 10 bitcoins are split, 7 bitcoins to Hitesh and 3 bitcoins to Irene. To advance the state of the channel, they will each create new commitment transactions reflecting the new channel balance.

As before, these commitment transactions are asymmetric so the commitment transaction each party holds forces them to wait if they redeem it. Crucially, before signing new commitment transactions, they must first exchange revocation keys to invalidate any outdated commitments. In this particular case, Hitesh’s interests are aligned with the real state of the channel and therefore he has no reason to broadcast a prior state. However, for Irene, state number 1 leaves her with a higher balance than state 2. When Irene gives Hitesh the revocation key for her prior commitment transaction (state number 1), she is effectively revoking her ability to profit from regressing the channel to a prior state because with the revocation key, Hitesh can redeem both outputs of the prior commitment transaction without delay. Meaning if Irene broadcasts the prior state, Hitesh can exercise his right to take all of the outputs.

Importantly, the revocation doesn’t happen automatically. While Hitesh has the ability to punish Irene for cheating, he has to watch the blockchain diligently for signs of cheating. If he sees a prior commitment transaction broadcast, he has 1,000 blocks to take action and use the revocation key to thwart Irene’s cheating and punish her by taking the entire balance, all 10 bitcoins.

Asymmetric revocable commitments with relative time locks (CSV) are a much better way to implement payment channels and a very significant innovation in this technology. With this construct, the channel can remain open indefinitely and can have billions of intermediate commitment transactions. In implementations of LN, the commitment state is identified by a 48-bit index, allowing more than 281 trillion (2.8 × 1014) state transitions in any single channel.

Hash Time Lock Contracts (HTLC)

Payment channels can be further extended with a special type of smart contract that allows the participants to commit funds to a redeemable secret, with an expiration time. This feature is called a hash time lock contract, or HTLC, and is used in both bidirectional and routed payment channels.

Let’s first explain the "hash" part of the HTLC. To create an HTLC, the intended recipient of the payment will first create a secret R. They then calculate the hash of this secret H:

This produces a hash H that can be included in an output’s script. Whoever knows the secret can use it to redeem the output. The secret R is also referred to as a preimage to the hash function. The preimage is just the data that is used as input to a hash function.

The second part of an HTLC is the "time lock" component. If the secret is not revealed, the payer of the HTLC can get a "refund" after some time. This is achieved with an absolute timelock using CHECKLOCKTIMEVERIFY.

The script implementing an HTLC might look like this:

IF

# Payment if you have the secret R

HASH160 <H> EQUALVERIFY

<Receiver Public Key> CHECKSIG

ELSE

# Refund after timeout.

<lock time> CHECKLOCKTIMEVERIFY DROP

<Payer Public Key> CHECKSIG

ENDIF

Anyone who knows the secret R, which when hashed equals to H, can redeem this output by exercising the first clause of the IF flow.

If the secret is not revealed and the HTLC claimed after a certain number of blocks, the payer can claim a refund using the second clause in the IF flow.

This is a basic implementation of an HTLC. This type of HTLC can be redeemed by anyone who has the secret R. An HTLC can take many different forms with slight variations to the script. For example, adding a CHECKSIG operator and a public key in the first clause restricts redemption of the hash to a particular recipient, who must also know the secret R.

Routed Payment Channels (Lightning Network)

The Lightning Network (LN) is a proposed routed network of bidirectional payment channels connected end-to-end. A network like this can allow any participant to route a payment from channel to channel without trusting any of the intermediaries. The LN was first described by Joseph Poon and Thadeus Dryja in February 2015, building on the concept of payment channels as proposed and elaborated upon by many others.

"Lightning Network" refers to a specific design for a routed payment channel network, which has now been implemented by at least five different open source teams. The independent implementations are coordinated by a set of interoperability standards described in the Basics of Lightning Technology (BOLT) repository.

Basic Lightning Network Example

Let’s see how this works.

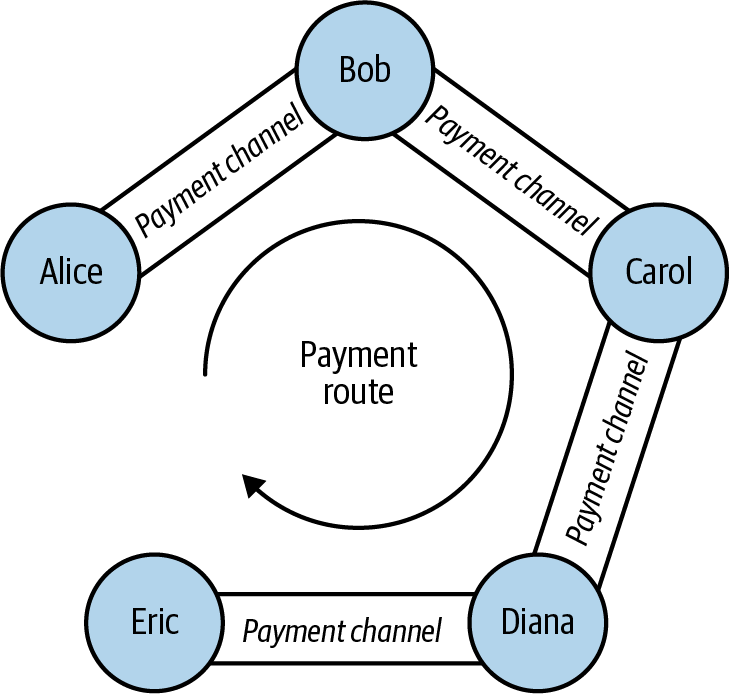

In this example, we have five participants: Alice, Bob, Carol, Diana, and Eric. These five participants have opened payment channels with each other, in pairs. Alice has a payment channel with Bob. Bob is connected to Carol, Carol to Diana, and Diana to Eric. For simplicity let’s assume each channel is funded with 2 bitcoins by each participant, for a total capacity of 4 bitcoins in each channel.

A series of bidirectional payment channels linked to form an LN that can route a payment from Alice to Eric. shows five participants in an LN, connected by bidirectional payment channels that can be linked to make a payment from Alice to Eric (see Routed Payment Channels (Lightning Network)).

Alice wants to pay Eric 1 bitcoin. However, Alice is not connected to Eric by a payment channel. Creating a payment channel requires a funding transaction, which must be committed to the Bitcoin blockchain. Alice does not want to open a new payment channel and commit more of her funds. Is there a way to pay Eric indirectly?

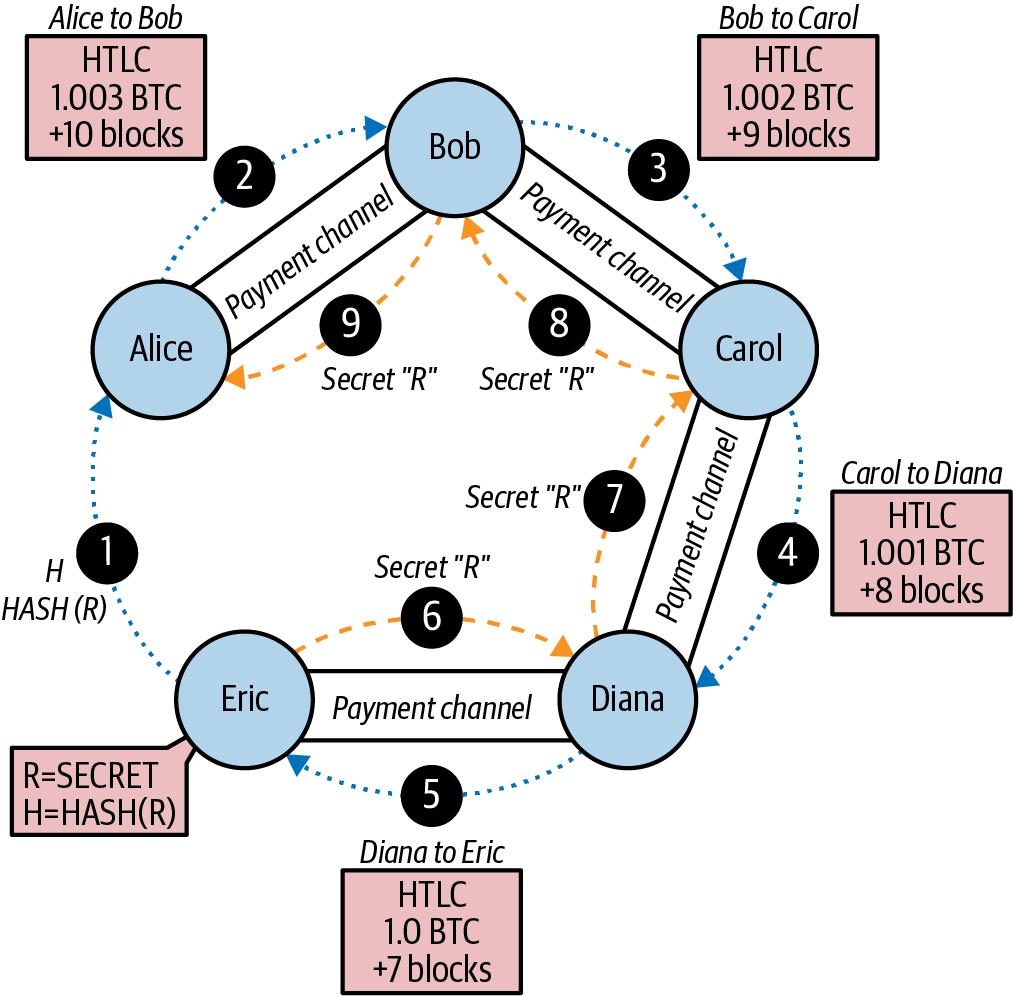

Step-by-step payment routing through an LN. shows the step-by-step process of routing a payment from Alice to Eric, through a series of HTLC commitments on the payment channels connecting the participants.

Alice is running an LN node that is keeping track of her payment channel to Bob and has the ability to discover routes between payment channels. Alice’s LN node also has the ability to connect over the internet to Eric’s LN node. Eric’s LN node creates a secret R using a random number generator. Eric’s node does not reveal this secret to anyone. Instead, Eric’s node calculates a hash H of the secret R and transmits this hash to Alice’s node in the form of an invoice (see Step-by-step payment routing through an LN., step 1).

Now Alice’s LN node constructs a route between Alice’s LN node and Eric’s LN node. The pathfinding algorithm used will be examined in more detail later, but for now let’s assume that Alice’s node can find an efficient route.

Alice’s node then constructs an HTLC, payable to the hash H, with a 10-block refund timeout (current block + 10), for an amount of 1.003 bitcoins (see Step-by-step payment routing through an LN., step 2). The extra 0.003 will be used to compensate the intermediate nodes for their participation in this payment route. Alice offers this HTLC to Bob, deducting 1.003 bitcoins from her channel balance with Bob and committing it to the HTLC. The HTLC has the following meaning: "Alice is committing 1.003 bitcoins of her channel balance to be paid to Bob if Bob knows the secret, or refunded back to Alice’s balance if 10 blocks elapse." The channel balance between Alice and Bob is now expressed by commitment transactions with three outputs: 2 bitcoins balance to Bob, 0.997 bitcoins balance to Alice, 1.003 bitcoins committed in Alice’s HTLC. Alice’s balance is reduced by the amount committed to the HTLC.

Bob now has a commitment that if he is able to get the secret R within the next 10 blocks, he can claim the 1.003 bitcoins locked by Alice. With this commitment in hand, Bob’s node constructs an HTLC on his payment channel with Carol. Bob’s HTLC commits 1.002 bitcoins to hash H for 9 blocks, which Carol can redeem if she has secret R (see Step-by-step payment routing through an LN. step 3). Bob knows that if Carol can claim his HTLC, she has to produce R. If Bob has R in nine blocks, he can use it to claim Alice’s HTLC to him. He also makes 0.001 bitcoins for committing his channel balance for nine blocks. If Carol is unable to claim his HTLC and he is unable to claim Alice’s HTLC, everything reverts back to the prior channel balances and no one is at a loss. The channel balance between Bob and Carol is now: 2 to Carol, 0.998 to Bob, 1.002 committed by Bob to the HTLC.

Carol now has a commitment that if she gets R within the next nine blocks, she can claim 1.002 bitcoins locked by Bob. Now she can make an HTLC commitment on her channel with Diana. She commits an HTLC of 1.001 bitcoins to hash H, for eight blocks, which Diana can redeem if she has secret R (see Step-by-step payment routing through an LN., step 4). From Carol’s perspective, if this works she is 0.001 bitcoins better off and if it doesn’t she loses nothing. Her HTLC to Diana is only viable if R is revealed, at which point she can claim the HTLC from Bob. The channel balance between Carol and Diana is now: 2 to Diana, 0.999 to Carol, 1.001 committed by Carol to the HTLC.

Finally, Diana can offer an HTLC to Eric, committing 1 bitcoin for seven blocks to hash H (see Step-by-step payment routing through an LN., step 5). The channel balance between Diana and Eric is now: 2 to Eric, 1 to Diana, 1 committed by Diana to the HTLC.

However, at this hop in the route, Eric has secret R. He can therefore claim the HTLC offered by Diana. He sends R to Diana and claims the 1 bitcoin, adding it to his channel balance (see Step-by-step payment routing through an LN., step 6). The channel balance is now: 1 to Diana, 3 to Eric.

Now, Diana has secret R. Therefore, she can now claim the HTLC from Carol. Diana transmits R to Carol and adds the 1.001 bitcoins to her channel balance (see Step-by-step payment routing through an LN., step 7). Now the channel balance between Carol and Diana is: 0.999 to Carol, 3.001 to Diana. Diana has "earned" 0.001 for participating in this payment route.

Flowing back through the route, the secret R allows each participant to claim the outstanding HTLCs. Carol claims 1.002 from Bob, setting the balance on their channel to: 0.998 to Bob, 3.002 to Carol (see Step-by-step payment routing through an LN., step 8). Finally, Bob claims the HTLC from Alice (see Step-by-step payment routing through an LN., step 9). Their channel balance is updated as: 0.997 to Alice, 3.003 to Bob.

Alice has paid Eric 1 bitcoin without opening a channel to Eric. None of the intermediate parties in the payment route had to trust each other. For the short-term commitment of their funds in the channel they are able to earn a small fee, with the only risk being a small delay in refund if the channel was closed or the routed payment failed.

Lightning Network Transport and Pathfinding

All communications between LN nodes are encrypted point-to-point. In addition, nodes have a long-term public key that they use as an identifier and to authenticate each other.

Whenever a node wishes to send a payment to another node, it must first construct a path through the network by connecting payment channels with sufficient capacity. Nodes advertise routing information, including what channels they have open, how much capacity each channel has, and what fees they charge to route payments. The routing information can be shared in a variety of ways, and different pathfinding protocols have emerged as LN technology has advanced. Current implementations of route discovery use a P2P model where nodes propagate channel announcements to their peers in a "flooding" model, similar to how Bitcoin propagates transactions.

In our previous example, Alice's node uses one of these route discovery mechanisms to find one or more paths connecting her node to Eric's node. Once Alice's node has constructed a path, she will initialize that path through the network by propagating a series of encrypted and nested instructions to connect each of the adjacent payment channels.

Importantly, this path is only known to Alice's node. All other participants in the payment route see only the adjacent nodes. From Carol's perspective, this looks like a payment from Bob to Diana. Carol does not know that Bob is actually relaying a payment from Alice. She also doesn't know that Diana will be relaying a payment to Eric.

This is a critical feature of the LN because it ensures privacy of payments and makes it difficult to apply surveillance, censorship, or blacklists. But how does Alice establish this payment path without revealing anything to the intermediary nodes?

The LN implements an onion-routed protocol based on a scheme called Sphinx. This routing protocol ensures that a payment sender can construct and communicate a path through the LN such that:

- Intermediate nodes can verify and decrypt their portion of route information and find the next hop.

- Other than the previous and next hops, they cannot learn about any other nodes that are part of the path.

- They cannot identify the length of the payment path or their own position in that path.

- Each part of the path is encrypted in such a way that a network-level attacker cannot associate the packets from different parts of the path to each other.

Unlike Tor (an onion-routed anonymization protocol on the internet), there are no "exit nodes" that can be placed under surveillance. The payments do not need to be transmitted to the Bitcoin blockchain; the nodes just update channel balances.

Using this onion-routed protocol, Alice wraps each element of the path in a layer of encryption, starting with the end and working backward. She encrypts a message to Eric with Eric’s public key. This message is wrapped in a message encrypted to Diana, identifying Eric as the next recipient. The message to Diana is wrapped in a message encrypted to Carol’s public key and identifying Diana as the next recipient. The message to Carol is encrypted to Bob’s key. Thus, Alice has constructed this encrypted multilayer "onion" of messages. She sends this to Bob, who can only decrypt and unwrap the outer layer. Inside, Bob finds a message addressed to Carol that he can forward to Carol but cannot decipher himself. Following the path, the messages get forwarded, decrypted, forwarded, etc., all the way to Eric. Each participant knows only the previous and next node in each hop.

Each element of the path contains information on the HTLC that must be extended to the next hop, the amount that is being sent, the fee to include, and the CLTV lock time (in blocks) expiration of the HTLC. As the route information propagates, the nodes make HTLC commitments forward to the next hop.

At this point, you might be wondering how it is possible that the nodes do not know the length of the path and their position in that path. After all, they receive a message and forward it to the next hop. Doesn’t it get shorter, allowing them to deduce the path size and their position? To prevent this, the packet size is fixed and padded with random data. Each node sees the next hop and a fixed-length encrypted message to forward. Only the final recipient sees that there is no next hop. To everyone else it seems as if there are always more hops to go.

Lightning Network Benefits

An LN is a second-layer routing technology. It can be applied to any blockchain that supports some basic capabilities, such as multisignature transactions, timelocks, and basic smart contracts.

LN is layered on top of the Bitcoin network, giving Bitcoin a significant increase in capacity, privacy, granularity, and speed, without sacrificing the principles of trustless operation without intermediaries:

- Privacy

-

LN payments are much more private than payments on the Bitcoin blockchain, as they are not public. While participants in a route can see payments propagated across their channels, they do not know the sender or recipient.

- Fungibility

-

An LN makes it much more difficult to apply surveillance and blacklists on Bitcoin, increasing the fungibility of the currency.

- Speed

-

Bitcoin transactions using LN are settled in milliseconds, rather than minutes or hours, as HTLCs are cleared without committing transactions to a block.

- Granularity

-

An LN can enable payments at least as small as the Bitcoin "dust" limit, perhaps even smaller.

- Capacity

-

An LN increases the capacity of the Bitcoin system by several orders of magnitude. The upper bound to the number of payments per second that can be routed over a Lightning Network depends only on the capacity and speed of each node.

- Trustless Operation

-

An LN uses Bitcoin transactions between nodes that operate as peers without trusting each other. Thus, an LN preserves the principles of the Bitcoin system, while expanding its operating parameters significantly.

We have examined just a few of the emerging applications that can be built using the Bitcoin blockchain as a trust platform. These applications expand the scope of Bitcoin beyond payments.

Now that you have reached the end of this book, what will you do with the knowledge you have gained? Millions of people, perhaps billions, know the name "Bitcoin," but only a small percentage of them know as much about how Bitcoin works as you now do. That knowledge is precious. Even more precious are the people, such as yourself, who are so interested in Bitcoin that you are willing to read several hundred pages about it.

If you haven’t already begun doing so, please consider contributing to Bitcoin in some way. You can run a full node to validate the Bitcoin payments you receive, build applications that make it easier for other people to use Bitcoin, or help educate other people about Bitcoin and its potential. You can even take the rare step of contributing to open source Bitcoin infrastructure software, such as Bitcoin Core, carefully working with a small number of incredibly smart people to build tools that no one will ever pay for but that billions may one day depend upon.

Whatever your Bitcoin journey, we thank you for making Mastering Bitcoin a part of it.